Bookkeeping For Small Businesses, Entrepreneurs, and Start-Ups

We help your business finances move forward on a good path

Our Job? To help you get your business finances organized so you know where your money is coming in and going out.

You’ll get clear and detailed reports so you can plan for growth in your business and help you be prepared for tax time.

Good Finances -- Good Business -- Goodway

〰️

Good Finances -- Good Business -- Goodway 〰️

Bookkeeping Tip:

It’s important to have a business bank account, even if you are just starting your business.

A few advantages of this are:

--It keeps business and personal finances separate.

--It helps you keep track of income and expenses in your business, especially the expenses.

--It helps you at tax time with proof of deductible expenses, making tax time less stressful.

--It keeps your business in better financial order.

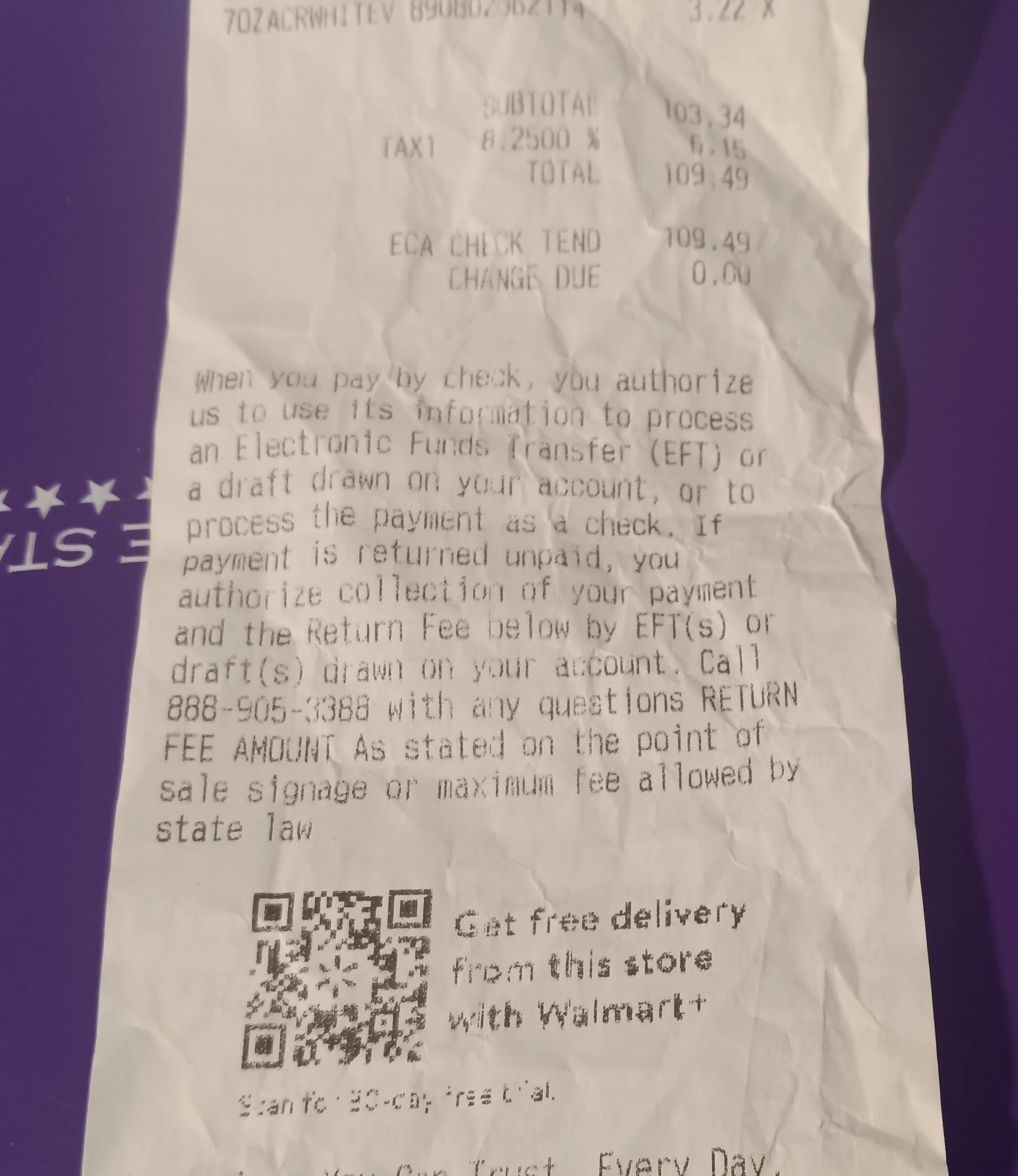

Bookkeeping Tip: Use business credit or debit cards as much as possible in your business. It’s a better way to track your expenses. Using cash forces you to keep paper receipts, which are easier to get lost somewhere. This benefit is two-fold: 1) You’ll have proof to deduct every dollar that is legally possible on your tax return, and 2) This will help you in your taxes in case you are audited by the IRS.

If you have to handle paper receipts for your business expenses, you may want to keep them organized in a simple filing system where they are separated into weeks, months, or categories. This will help you now in bookkeeping and when it’s time to file your taxes.

Contact us today: Call or Text 832-721-3465

<<< Or you can use this quick form to the left and we’ll get back to you so we can chat about your bookkeeping needs.